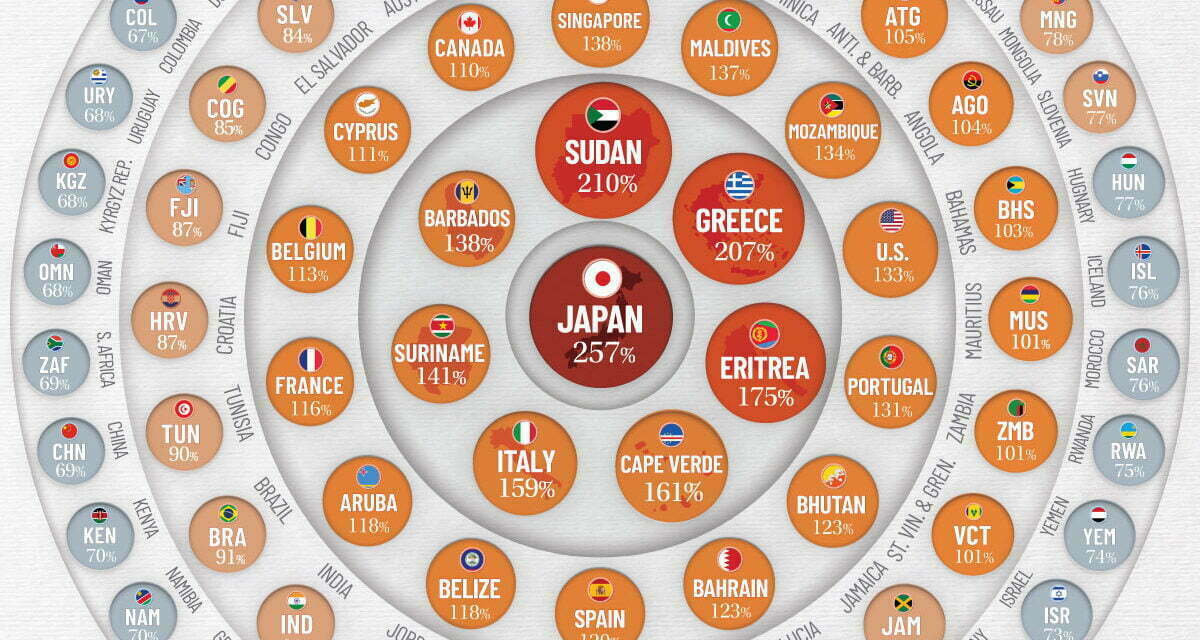

Turns out that almost every country in the world has a problem with their government borrowing too much money.

Japan is the worst, having borrowed 257% of their GDP. I remember back in the 80s and 90s they almost always had a surplus.

The U.S. appears to be at 133% right now, if you believe the chart.

But sovereign countries who print their own money, can print more, and then inflation takes care of it. That is Modern Monetary Theory.

Does that sound right to you?